"Dr. Zoidberg - RIP Oppo" (thetomselleck)

"Dr. Zoidberg - RIP Oppo" (thetomselleck)

11/15/2019 at 22:23 ē Filed to: late night FP theft

1

1

40

40

"Dr. Zoidberg - RIP Oppo" (thetomselleck)

"Dr. Zoidberg - RIP Oppo" (thetomselleck)

11/15/2019 at 22:23 ē Filed to: late night FP theft |  1 1

|  40 40 |

Image: Inception of image

With apologies to Tom, I just canít read through 500+ comments of non-Oppos. So Iím bringing it to non-n on -Oppo.

We all acknowledge there can be no universal rule or percentage. Everyoneís overhead is different. Everyoneís priorities are different. And so on. We might think 100% is excessive, but also that 10% isnít really feasible for tens of millions of people.

Speaking for myself...

Iíve pretty much discovered that Iíve been... shaped... by some of my earlier financial struggles. Iíve gone broke twice. Iíve turned off the heat in winter so I can afford rent. Lots of skipped meals... Iíve put up with ó in hindsight ó highly dubious living circumstances just to scrape by.

So many years later, when I started making ďokayĒ money, I found I still consumed as though I had none. When I bought my 17-year old car for cash, I was having an existential crisis. I still kind of am. I often feel like I belong in a shitbox... Iíve still never spent five-figures on a car.

I guess if I had to shop for a new vehicle today, I probably... wouldnít. Iíd maybe kind of fix up my pickup and bounce around in that and save save save! Then after my wife tells me for the thousanth time that she doesnít want me to die, Iíd spend like ehhhhh $8k-$15k, something AC and airbags I guess.

But how about your personal anecdote, if youíre willing to share?

CarsofFortLangley - Oppo Forever

> Dr. Zoidberg - RIP Oppo

CarsofFortLangley - Oppo Forever

> Dr. Zoidberg - RIP Oppo

11/15/2019 at 22:27 |

|

All of it I think.

fintail

> Dr. Zoidberg - RIP Oppo

fintail

> Dr. Zoidberg - RIP Oppo

11/15/2019 at 22:29 |

|

As long as I make more than I spend and put something away for tomorrow, I will drive what I like, and wonít bemoan anyone who is similar. Being single helps with this. Tomorrow isnít guaranteed, enjoy something today, whatever your fixation may be. I fear these are the good old days.

I loathe these formulas that claim something like 10%, complete idiocy, if this was followed as a rule, there would be almost no new car sales.

CarsofFortLangley - Oppo Forever

> CarsofFortLangley - Oppo Forever

CarsofFortLangley - Oppo Forever

> CarsofFortLangley - Oppo Forever

11/15/2019 at 22:30 |

|

Realistically, it depends on a lot of factors. How old you are, kids, cost of living. I count driving as my hobby and entertainment, so those budgets basically go into my driving.

If I was a ďnormieĒ I think Iíd spent about a third of what I currently do on cars.

4 vehicles, insurance for 3, maintenance, parts, and premium gas for the truck, Sportwagen and ST? Not good financial decisions. But it's what I love.

dogisbadob

> Dr. Zoidberg - RIP Oppo

dogisbadob

> Dr. Zoidberg - RIP Oppo

11/15/2019 at 22:30 |

|

I Like a cheap car for a daily driver. Maybe if I had a lot of money Iíd buy something newer

If only EssExTee could be so grossly incandescent

> Dr. Zoidberg - RIP Oppo

If only EssExTee could be so grossly incandescent

> Dr. Zoidberg - RIP Oppo

11/15/2019 at 22:31 |

|

While I am comfortably above the poverty line,I very rarely have large amounts of money in the bank due to high cost of living . Once this car dies for good Iíll probably have to finance something as $200/mo is easier to scrape up than $3-5k to just buy something outright.

Dr. Zoidberg - RIP Oppo

> fintail

Dr. Zoidberg - RIP Oppo

> fintail

11/15/2019 at 22:32 |

|

In 2011, I made... I think $9k? I bought a $1,700 pickup. By that percentage, I spent DOUBLE what I should have :O

Dr. Zoidberg - RIP Oppo

> CarsofFortLangley - Oppo Forever

Dr. Zoidberg - RIP Oppo

> CarsofFortLangley - Oppo Forever

11/15/2019 at 22:34 |

|

I pass no judgment. Most people thinks Iím crazy for my financial decisions. They just donít heavily involve cars.

My X-type is too a real Jaguar

> Dr. Zoidberg - RIP Oppo

My X-type is too a real Jaguar

> Dr. Zoidberg - RIP Oppo

11/15/2019 at 22:34 |

|

Generally a third, thatís my goal one third of my after tax after retirement pay. Per month for my payment, I also keep my cars until well after they are paid off.†

fintail

> Dr. Zoidberg - RIP Oppo

fintail

> Dr. Zoidberg - RIP Oppo

11/15/2019 at 22:38 |

|

According to some drones no doubt clogging the left lane in a miled up Prius right now, you should have spent $900.††

Deal Killer - Powered by Focus

> Dr. Zoidberg - RIP Oppo

Deal Killer - Powered by Focus

> Dr. Zoidberg - RIP Oppo

11/15/2019 at 22:42 |

|

Iím looking for a replacement for my car, which will be passed to my 17 year old

son for his use to and from school and, I hope, future employment. Due to unreal health insurance costs ($750/month,

Really?

), my price range is about $7,000, give or take. Iíd love to be able to afford a better car, not for me but for my wife, but circumstances just donít allow for that right now. The idea of spending $30K or more for a car? Thatís just fucking nuts to me. Of course, YMMV.

BlueMazda2 - Blesses the rains down in Africa, Purveyor of BMW Individual Arctic Metallic, Merci Twingo

> Dr. Zoidberg - RIP Oppo

BlueMazda2 - Blesses the rains down in Africa, Purveyor of BMW Individual Arctic Metallic, Merci Twingo

> Dr. Zoidberg - RIP Oppo

11/15/2019 at 22:46 |

|

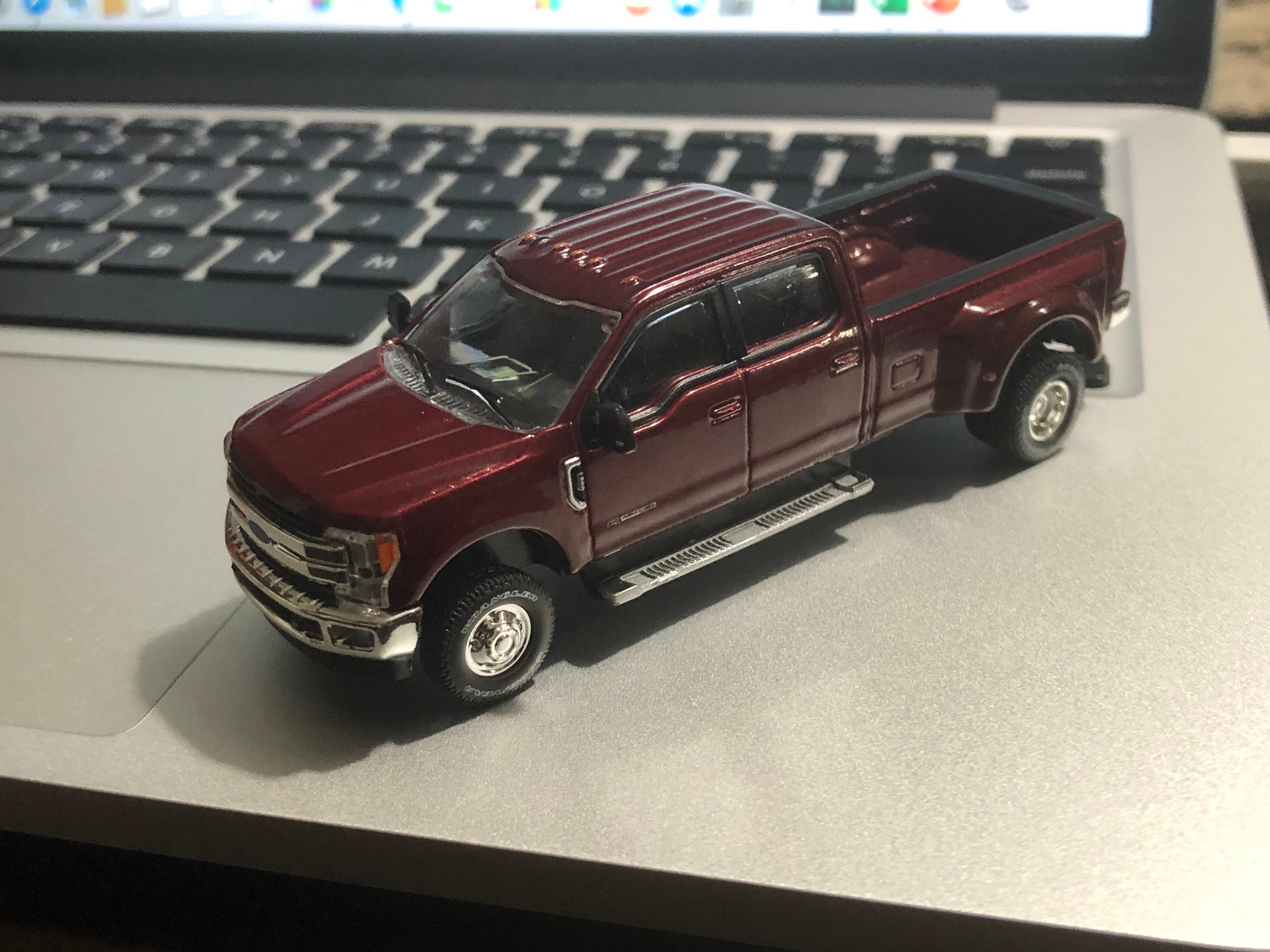

Iím a college student working on financial spreadsheets for work in one window and building the 2020 F-350 Tremor in another.

And trying to ignore the eternally fucked Passat parked outside.

Why am I not sitting in one of those in my driveway?

UPDATE: I just checked my bank account balance and will now refrain from building them and continue admiring my $5 F-350 from Hobby Lobby.

CompactLuxuryFan

> Dr. Zoidberg - RIP Oppo

CompactLuxuryFan

> Dr. Zoidberg - RIP Oppo

11/15/2019 at 22:46 |

|

Iím still pretty young, single, and will probably be childless forever. I live in a very high cost area, so pretty much all online financial advice goes out the window. No ďhow much should I spend on rent?Ē article will save you in San Francisco.

Iíve just recently started regularly meeting up with a financial advisor. Itís been great for peace of mind, assuring me I will be able to have enough for retirement if I stay the course. Iíve also recently decided Iím buying a brand new car (that one could happen very soon).

Much like fintail, Iíve realized I might as well enjoy what I have now instead of waiting and waiting. I already have enough trouble getting excited about things as is, so if I am excited about something I should probably strike while the ironís hot. For auto enthusiast s, it seems to be a pivotal time, with gas powered cars being better than ever (except for styling?) and the EV-pocalypse being nigh . If you dream of a brand new, affordable, manual Toyota hatchback, you might wanna get on that .

Finally , my last three cars have been a cycle of:

looking at heavily depreciated used cars

finding little things wrong with all of them

buying one

finding many more little things wrong with it

assuming a bunch more things are going to go wrong and wear out gradually

not fixing anything up because I figure the next repair bill is right around the corner

being stressed about so many little things being wrong with my car

the car proceeding to not show absolutely any additional wear during my ownership

My conclusion is that I am amazing at taking care of cars, so if I start with a brand new one, it will probably stay in minty condition and satisfy me for a very long time.

wafflesnfalafel

> Dr. Zoidberg - RIP Oppo

wafflesnfalafel

> Dr. Zoidberg - RIP Oppo

11/15/2019 at 22:51 |

|

You are giving that Lexus a better life than 99 % get - no regrets necessary .

Only went broke once, largely due to some slightly undisclosed debt my wife had when we got married , (oopsie!) Always driven ďcheapĒ cars though have gotten relatively lucky with the used vehicles and consistently leaned ďsportyĒ or at least engaging. But with the last vehicle I was getting old, really needed something better for my own mental health. I had a buddy introduce me to the best car sales guy I had ever worked with and he got me exactly what I wanted for a great price.

I think the flaw in McParlandís article is that it focuses on the average person, not the crazy a$$ OPPO car nut. If you are a person that gets so much joy out of just a cold start in the garage at work setting off a couple car alarms in the process then Iíd say the figures get skewed. I figure itís my transportation, hobby, entertainment, gold chains and mental health budget all wrapped up together. It let me get my dad to see his twin brother an hour before he slipped away, ďhold on pops †- we got this...Ē Iím a fiscally conservative guy, but I will never regret that purchase.††

Snuze: Needs another Swede

> Dr. Zoidberg - RIP Oppo

Snuze: Needs another Swede

> Dr. Zoidberg - RIP Oppo

11/15/2019 at 22:55 |

|

Thats a good question!

My wife has always had hand-me-downs (Jeep Cherokee, Lexus RX330) and Iíve mostly driven either decent used cars (CPO Grand Prix, Used low mileage WRX) or relatively cheap new cars (Cobalt, Cruze). I would say between us we are making more than the average married couple but we live in o ne of the higher cost of living areas (DC).

One thing I look at is Total Cost of Owneship. Whats fuel economy like? How will it affect my insurance? What are spare/replacement part costs like? How much maintenance can I do myself? Then I go by the ďruleĒ of ďminimum 20% down, finance for no longer than 60 months.Ē If you donít have that money for a payment and canít afford that monthly, youíre spending too much.

Our most recent purchase was the 2018 Terrain Denali. We were well under the ďruleĒ - with our insurance payout on her Lexus and some savings we put about 40% down and only had to finance for 48 months. We will have it paid off in about 30 months. And we are still saving money each month. It also gets like 40% better fuel economy than the Lexus, parts are much cheaper, and Im generally more confident in doing most of the work on it myself.

Like you, Iíve been in financial shit before and it sucks. My wife really helped me get my shit together and now I love not having to stress about money. But Ive learned part of that is also not setting myself up to stress about money. We could have gone for a much fancier SUV or something, but the Denali was ďnice enoughĒ and met all our needs and was easily in budget. Neither of us are show-offs and need a fancy badge on the hood or grill. I would love to have a new car but weíve run the numbers and while we can ďaffordĒ it, we wouldnít be making our savings goals and put us dangerously close to living paycheck to paycheck, which is why Iím holding off.

gmporschenut also a fan of hondas

> Dr. Zoidberg - RIP Oppo

gmporschenut also a fan of hondas

> Dr. Zoidberg - RIP Oppo

11/15/2019 at 23:01 |

|

i look at total cost of owneship.

Cousin A: librarian, doesnít make a lot bought a used legacy, @30% of her income. rea sonable, it will last a while

Cousin B: doesnít make a lot, bought a CPO c class, doesnít do anything herself .: moron

Coworker A: buys used, fixes up, sells 6 moths later for more than he paid for. smart

Coworker B: has 15 year old german car, requires multiple thousands every 4-6 m onths. ďi canít afford a new carĒ. car breaks down every 4-6months often leading to missed days.

the problem in all of these rules is there is way to much variation on your income status and needs. I think over your income is dumb, at the same time, I live in the land of salt and cars i see for $ 1- 2k IMHO should often be sent to the scrapyard† (if we brought back inspections, but thats a whole other rant) .

f86sabre

> Dr. Zoidberg - RIP Oppo

f86sabre

> Dr. Zoidberg - RIP Oppo

11/15/2019 at 23:03 |

|

I bought the Mini from Flavien 2 years ago and paid cash for it. It was the first time since I bought my first car in 1990 for $2000 that I was able to pay for a car in full up front. We will be able to pay off my wifeís 2018 Honda Odyssey in 2.5 years. Thatís a pretty good clip. We bought the 03 Evo and the 05 Mini and paid both off in 3 years and continue to drive them today. That long spell without car payments allowed us to do a lot of fun things. So, I guess my point of view is to buy good stuff, pay it off as quickly as practical and then take good care of them and drive them for a† long time.

HFV has no HFV. But somehow has 2 motorcycles

> Dr. Zoidberg - RIP Oppo

HFV has no HFV. But somehow has 2 motorcycles

> Dr. Zoidberg - RIP Oppo

11/15/2019 at 23:21 |

|

My rule of thumb has been figure out what you can spend on a mounthly payment+insurance and make sure youíre payment minimum payment+insurance is about 5/8 that. And make sure the car will be paid off before it becomes a problem. As in donít get a 7 year loan on a 3 year old car just so you can swing the payment.

And Never accept an interest rate over 5%. If you have that long Iíd credit problem †get a bike. It what ever you can pay cash for†

slipperysallylikespenguins

> Dr. Zoidberg - RIP Oppo

slipperysallylikespenguins

> Dr. Zoidberg - RIP Oppo

11/15/2019 at 23:25 |

|

Iím very fortunate in that I am actively put off by 99% of newer cars, so old crapcans work for me. Iíve never spent more than 15% of yearly salary on an automobile purchase, and donít make a whole lot. Anything over 30% seems absurd to me . I avoid payments like the plague.

HFV has no HFV. But somehow has 2 motorcycles

> BlueMazda2 - Blesses the rains down in Africa, Purveyor of BMW Individual Arctic Metallic, Merci Twingo

HFV has no HFV. But somehow has 2 motorcycles

> BlueMazda2 - Blesses the rains down in Africa, Purveyor of BMW Individual Arctic Metallic, Merci Twingo

11/15/2019 at 23:26 |

|

New trucks are way too expensive. Unless you neeeeeed one for your career they silly. When worked at dealership I say people driving away with 700/month payments on 84 month† loans. Iíd rather just shoot my self†

HFV has no HFV. But somehow has 2 motorcycles

> gmporschenut also a fan of hondas

HFV has no HFV. But somehow has 2 motorcycles

> gmporschenut also a fan of hondas

11/15/2019 at 23:34 |

|

It is getting harder and harder to find a decent car for less than 3k.

A ďfriendĒ of mine really pisses omme off. He has some money from a law suit and heís been using it to buy to crap cars for bottom dollar and then turn around and sell them for more. He calls it a hustle I call it taking advantage of those at a disadvantage.

We drove buy a Chevy cobalt that was basically rusted so bad it wouldnít pass any state inspection ever. Of coarse Wisconsin doesnít have one at all. He told me he was going to come by later and see if he could buy it cheap. I told he straight up ďif you sell some one that car and make a buck on it youíre liable for when they get T- boned and die, because that cars B pillar isnít connected to the floor anymore . Not legally but morally.Ē

HFV has no HFV. But somehow has 2 motorcycles

> My X-type is too a real Jaguar

HFV has no HFV. But somehow has 2 motorcycles

> My X-type is too a real Jaguar

11/15/2019 at 23:35 |

|

My car was 10k I make about 30/year. Iíll have it paid off in 34 months if all goes well.†

Thisismydisplayname

> Dr. Zoidberg - RIP Oppo

Thisismydisplayname

> Dr. Zoidberg - RIP Oppo

11/15/2019 at 23:49 |

|

We typically only purchase whatever we can pay either cash for or finance for 3 years or less. The last purchase we made was our Pacifica and it was the only car Iíve ever bought new, and probably the last. We ended up around $38k and thatís been about the limit for us. Eventually it just gets to a point of diminishing returns. Most late model cars are all safe enough now, so thatís not a big deal anymore, so it comes down to value. And you can get a lot of car for $20k or much less.But weíve paid $20-$25k for a couple of our cars and thatís a pretty comfortable place to be. †

shop-teacher

> Dr. Zoidberg - RIP Oppo

shop-teacher

> Dr. Zoidberg - RIP Oppo

11/15/2019 at 23:49 |

|

All of my life, my dad has bought new cars at alarming frequency. Early on in my career, I started on that path as well. I quickly realized how much that was costing me, and my inherent cheapness kicked in. I do believe in buying new cars, because my experience with CPO cars went amazingly horribly. Where things get responsible, is I pay them off and keep them a long time. When we had to get a bigger vehicle when kid #2 was on the way, we did do the ďdum bĒ thing and finance it for six years to keep the payment low. But we put enough down that we were never upside down on the loan, and we plan to keep the car for at least 15 years.

lone_liberal

> Dr. Zoidberg - RIP Oppo

lone_liberal

> Dr. Zoidberg - RIP Oppo

11/15/2019 at 23:52 |

|

We never have more than one car loan at a time and we havenít had even that for three years. The last car loan was probably 25% plus or minus. This time all of our other debt,† other than the house, will be gone but even then I doubt we go more than thirty and it will probably be much less.

gmporschenut also a fan of hondas

> HFV has no HFV. But somehow has 2 motorcycles

gmporschenut also a fan of hondas

> HFV has no HFV. But somehow has 2 motorcycles

11/15/2019 at 23:53 |

|

Its part of the reason i bought a relatives crz. It spent 7 of its 8 years outside the northeast.

Moron coworker b was trying to find a car for his sister divorcee in her 50s, adn wanted me to look at all the CL ads . ďher budget is only 2kĒ me:Ē you can see the rust bubbles all along the floorĒ. Nothing he showed looked like it had tires from this decade, or a proper service in a similar timeframe. .

HFV has no HFV. But somehow has 2 motorcycles

> gmporschenut also a fan of hondas

HFV has no HFV. But somehow has 2 motorcycles

> gmporschenut also a fan of hondas

11/15/2019 at 23:55 |

|

I think at this point if youíre in that budget your better off looking on Facebook

Nothing

> Dr. Zoidberg - RIP Oppo

Nothing

> Dr. Zoidberg - RIP Oppo

11/16/2019 at 00:20 |

|

Monthly payment wise, weíre at about 5% of our net. Iíve got about 16 months left on the Ď19 4runner. Iím trying to hold off buying a fun/project car until the 4Runner is paid off, but my wandering eye is always wandering.

Iíve struggled in the past. Part of the allure of Toyota trucks to me is the ease of which to get out of them if financial stress were to hit again. When I had my Ď02 Tundra, it was my first ever new vehicle purchase, only to get laid off not long after. Thankfully, resale helped from killing me at the time. It was that situation that kept my in sub $2k cars, replaced every year or so for about 7 years, even though I could afford something nicer. It was my wife that finally convinced me to get something new again, even though Iím still fairly uncomfortable doing so. I still think I might feel ďbetterĒ in an older Cruiser, although Iím now darn close in loan balance to what a decent 100 would cost with 15x †the miles of the 4Runner.

CB

> Dr. Zoidberg - RIP Oppo

CB

> Dr. Zoidberg - RIP Oppo

11/16/2019 at 00:25 |

|

I probably put about 1/6th of my pay into my car. Hoping to get it paid off so I can put that money into other things. Like a new car.

My financial reasoning for that is that buying something new and more practical means I can hold onto it for more of my adult life. Pay it off quickly and then use the remaining money for a house. I have a pension and a retirement plan, so at this point, it's saving for a house in probably four years.

Eric @ opposite-lock.com

> Dr. Zoidberg - RIP Oppo

Eric @ opposite-lock.com

> Dr. Zoidberg - RIP Oppo

11/16/2019 at 00:39 |

|

All income calculations are pre-tax, as in the original article.

For the 8 years before I bought the FoST, I spent ~0.5% of my average income annually on my car, fuel, maintenance, insurance, and registration. Mind you, this was a shitbox, I looked for ways to burn money maintaining it , and this doesnít count †the sale of the car, which would drop it even further.

With everything counted as above, my FoST costs ~2.8% of our combined household income. Kind of ridiculous considering I drive it maybe 3 times a week on a typical week and 2 of those are usually a 2.4-mile round trip. On the upside, itís almost paid off and the cost to maintain it will be negligible.

My wifeís car was more expensive, is more expensive to insure (marginally), and consumes more fuel (estimated, plus itís driven more), so itís ~4.3%. This is enough that it makes me slightly uncomfortable.

As mentioned above, we finance these cars because we can for zero or near-zero interest, so it spreads across 5 years then most of the annual cost drops off. You also need to consider that cars last at least 10 years in our household, so the total cost is even less and they still have some residual value...

Eric @ opposite-lock.com

> CompactLuxuryFan

Eric @ opposite-lock.com

> CompactLuxuryFan

11/16/2019 at 00:45 |

|

A lot of your thoughts, plus the cost of used ones, went into my decision to buy my car new... My old shitbox was worth more after I drove it over 50k miles than I paid for it originally.

SilentButNotReallyDeadly...killed by G/O Media

> Dr. Zoidberg - RIP Oppo

SilentButNotReallyDeadly...killed by G/O Media

> Dr. Zoidberg - RIP Oppo

11/16/2019 at 02:42 |

|

I bought a AU $45k Volkswagen in 2002...borrowed 8 grand to do it. Rest was selling fully owned previous vehicle privately and savings. I think I earned around 70k a year back then and pretty much every year since. Havenít bought another car since...

Mílady bought her Forester outright in 2001 using savings. Also hasnít bought another car since. Her income wasnít dissimilar back then but itís more †now... however I'm no longer earning an income.

Nick Has an Exocet

> Dr. Zoidberg - RIP Oppo

Nick Has an Exocet

> Dr. Zoidberg - RIP Oppo

11/16/2019 at 02:44 |

|

Ive done both. I recently realized that I got no greater joy out of spending $26k for my Lancer than out of $900 for Miata. The only thing that matters is whether the car gives you the experience you want or the safety you need. 2 days after buying the Lancer, I was able to avoid a head on accident thanks to the carís AWD that probably would have sent me to the hospital or worse in my previous car. Thereís something to be said for that. In my case, I was able to use the differential and transfer case to put power down into a snowbank while the left side of the car was entirely on ice. The woman who slid into my lane from the opposite direction slammed he ad-on into the car behind me instead.

The Exocet is something different. Made with my bare hands (and the tiny fingers that assemble Ryobi tools). Safety? Not really. Pride? Fuck yes.

As it stands today, Iím very unemployed with no unemployment benefits left. So Iím very happy to not have a car payment. I donít think I ever really want a car payment ever again. The only exception may b e leasing something electric to get me cheaply to/from work at some point. Unless I had kids. That changes things a bit.†

The last thing Iíll say is: donít tie your own self-worth to your car. Thatís not fair. Thatís what idiots who are stuck in 84 month loans on cars they canít afford do.

G_Body_Man: Sponsored by the number 3

> Dr. Zoidberg - RIP Oppo

G_Body_Man: Sponsored by the number 3

> Dr. Zoidberg - RIP Oppo

11/16/2019 at 05:57 |

|

I like to go by† the Elantra rule. If the cost of depreciation and repair is less than the cost of leasing a base Elantra (and they do have some killer lease deals), itís all good. If you do your own wrenching your can own some surprisingly nice stuff within that budget (my G35 for example, or an E90 328i). Considering how much I value fun and general enjoyment in a car, I figure thatís a pretty reasonable mandate.

RallyDarkstrike - Fan of 2-cyl FIATs, Eastern Bloc & Kei cars

> Dr. Zoidberg - RIP Oppo

RallyDarkstrike - Fan of 2-cyl FIATs, Eastern Bloc & Kei cars

> Dr. Zoidberg - RIP Oppo

11/16/2019 at 06:16 |

|

I would say, car-wise, as much as I would like a new car, I would likely never buy one. I can find something that suits me perfectly fine that is still very reliable and in great shape used for less than 5 figures...so why would I go out and pay a crap-ton more?

Even though I would also have enough for something fancier than what I drive, I LIKE having a more basic car, so paying a lower price to get something nobody else seems to want is fine with me. Both my old Subaru and my current Accent were around $7000.....$6900 or so for my Subaru plus some fees and $6990 all-in for my Accent. Humdrum had 54,000kms on it when I got her and it had been on the dealer lot for a year because nobody wanted a manual car with literally no options...saved me a lot of money that way!

I still live at home as, being a substitute teacher, I donít have a full-time permanent job anywhere yet. Iím also trying to save up for a house of my own, so all my money is going towards a big downpayment for that. Doesnít leave me with much to spend for an expensive car, but I still have plenty for maintenance and things to keep Humdrum going, like undercoatings every year and a little for rust repairs here and there.

I have been putting a TINY shred of my income away in a small fund since like...2005...

that has managed to grow to about $8K. Itís to buy/import a FIAT 126p, so I have enough money for that now...but I donít yet have a place to properly store it. The other issue there is, even after I start that process, I know it is going to make me think the same way you were (ďconsume as if I had noneĒ) in the sense that I know I can afford it, and will afford it, but alarm bells will be going off in my head the entire time saying ĎTHIS IS WASTEFUL! YOU DONíT NEED THIS!í

Manny05x

> Dr. Zoidberg - RIP Oppo

Manny05x

> Dr. Zoidberg - RIP Oppo

11/16/2019 at 06:56 |

|

12k the cut off for me to spend on a car. Cars are a huge financial decision and although we love them they are not a smart one.

Thomas Donohue

> Dr. Zoidberg - RIP Oppo

Thomas Donohue

> Dr. Zoidberg - RIP Oppo

11/16/2019 at 10:26 |

|

With apologies to Tom, I just canít read through 500+ comments of non-Oppos. So Iím bringing it to non-non-Oppo.

This is me, every day, resisting the urge to re-post over here.

Did his 10% include insurance, etc? Because that varies greatly depending on who you are and where you live. At first it didnít seem like a lot to me, but then I did the math and in no way do I want to spend that much. Iíve only bought one new car in my life, since then Iíve gone the used route to avoid depreciation and i ns tead increase my repair/maintenance spending. But, Iíd rather have nicer /better used cars that I like to drive.

The Touareg is getting old so Iím in that spot again right now, trying to decide what I want, and how much to spend. But I doubt Iíll go over $25k - that will put me at financing ~$20k over four years, well below the 10% but if you add insurance, repairs, and continued maintenance on the Boxster, Iím probably closer to the 10% than I realize.

KingT- 60% of the time, it works every time

> Dr. Zoidberg - RIP Oppo

KingT- 60% of the time, it works every time

> Dr. Zoidberg - RIP Oppo

11/16/2019 at 10:36 |

|

This is an enthusiast site but there are much more important things in life. I have actually found myself restricting my car budget even as my income has increased, thanks to discovering the magic of company matching and compound interest through this wonderful thing called 401k.

I would say that how good cars are now these days you dont necessarily have to spend big bucks to get the performance and features you want. Can I afford to lease a $45K car? Sure. Buy a $35k car? Sure. But I can get pretty good cars for $25k or less†

Land_Yacht_225

> Dr. Zoidberg - RIP Oppo

Land_Yacht_225

> Dr. Zoidberg - RIP Oppo

11/16/2019 at 11:40 |

|

In my experience selling cars (for the 18 months that I did) everyone is still chasing the $250/mo payment theyíve been chasing for 25 years - people just arenít willing to accept what kind of car that puts them in.

Myself on the other hand: $250/mo for no more than 36 months, even at a moderate interest rate, is still $8-9,000 for a car. And that puts me well in the neighborhood of the 12 year old 7-Series/A8/S-Class/XJ market I would want to be in anyway. I canít stomach depreciation. Even if I could afford a newer one, I wouldnít. Now, where I go off the rails is total cost of ownership. Which is to say itís never even part of the thought process. If I buy a $135,000 Mercedes for $9,000 - Iíd have to dump $126 ,000 into it in maintenance and repairs before my personal value calculation goes into the red. A Mercedes is a nightmare to own, but it's not a $10,000 a year nightmare to own. Not even a used Bentley Continental would be that bad. Yeah, the first couple years you might be catching up on neglect, but every car has a tipping point once you've thrown enough good money after bad. I haven't had a $1,000 plus repair bill on my 600 in 3 years that was a necessity - sure, I'll stack up elective stuff into 4 figures when the credit card gets paid down - but there's never been an "emergency" since the suspension pump.

RPM esq.

> Dr. Zoidberg - RIP Oppo

RPM esq.

> Dr. Zoidberg - RIP Oppo

11/16/2019 at 18:04 |

|

I paid off my student loans very aggressively and made some real quality-of-life

sacrifices to do so, and now I

use the logic from the Top Gear cheap racecar episode: take what youíd spend on a hobby you donít have and add it to the car budget if cars are your hobby. Plus, t

he real price of cars is depreciation, so Iím not particularly worried about most of the equity parked in my 4Runner

. The AMG is basically

where the hobby money goes, but it should be a relatively desirable/collectible model

and I bought it at

3 years old

for about half its original MSRP

,

so somebody else already took the bad bath on it

. A

s in the Top Gear episode, the hobby I donít have is golf, so I can afford to eat some depreciation/maintenance/

tires

in the service of fun. If I ever take up golf, Iíll adjust my car spending appropriately.

Someone is probably

going to yell at me that I should be investing more, which is undoubtedly true, but Iím decent

at saving

,

Iím only 35 and have a fair amount of equity in my house

, and Iím not spending more than I can afford month-to-month. The overall picture is solid.

thatsmr

> Dr. Zoidberg - RIP Oppo

thatsmr

> Dr. Zoidberg - RIP Oppo

11/17/2019 at 13:11 |

|

At the ripe age of 50, I have owned 15 vehicles if you include the Datsun pickup I bought for 50 bucks which turned out to not be a sexy enough project to start, so sold for 50 to the next guy. My current ride is only my third financed ever at a whopping 153/mo, the first I ever financed was my 86 CRX si around 1990 and I only financed around three grand/36 mos. Never have had a car in mind when I needed another car, but something cool or at least less common has popped up when the need arised including three Alfa dds